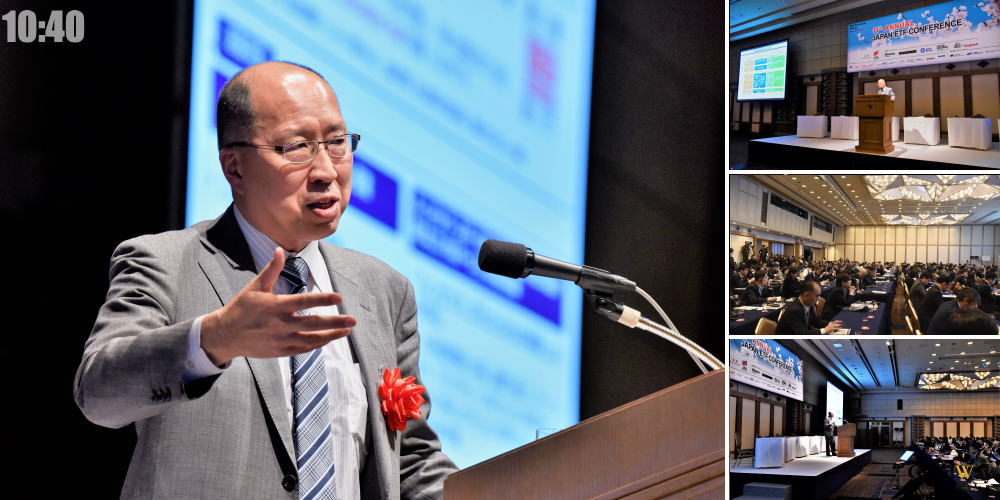

As well as last year, S&P DJI hosted its “11th Annual Japan ETF Conference” in Imperial Hotel. The conference was held for two days from April 2 ~ 3 2019, with the theme of “The beginning of the new financial era and the possibility of business evolution of ETF”.

This year, S&P DJI expanded the conference to a two-day format to accommodate the increasing number of ETF topics as asset managers in Asia are increasingly using ETFs in their investment strategies. The 1,300 delegates came from not only Japan but all across the Asia Pacific region including Hong Kong, Australia, Korea, Singapore, and Taiwan.

The following photographs show the state of the conference for Day 1.

【10:00】 Opening Remarks

Alexander Matturi, Chief Executive Officer, S&P Dow Jones Indices

Session 1: Taking a Closer Look at the Global ETP Market

【10:10】 ETF and Evolving Asset Management Industry

Katsumi Fujikawa, Managing Director, Head of Corporate Planning Group and Chief of Staff, Head of ETF Business Group, BlackRock Japan Co.,Ltd.

【10:40】Keynote Speech

Toshihide Endo, Commissioner, Financial Services Agency

【11:10】Panel: Spotlight on New Financial Business Trends

Panelists:

Kazuhisa Shibayama, Chief Executive Officer, WealthNavi Co.,Ltd.

Takashi Fujita, President & Representative Director, KDDI Asset Management Co.,Ltd.

Asumi Kantake, Chief Executive Officer, tsumiki Co.,Ltd.

Moderator:

Keiichi Ohara, Chief Executive Officer, Japan Asset Management Platform Group Co.,Ltd.

【12:00】Networking Lunch: Sponsored by Partners

The attendees enjoyed Imperial Hotel-specific buffet lunch among the luxurious atmosphere.

Session 2:Examining the Impact of ETFS on Japan's Investment Landscape

①【13:00】Panel: Making Sense of Requlations and Taxes When Accounting for ETFs

Akemi Kito, C.P.A/ Certfied Public Tax Accountant Financial Services, PwCTax Japan

Dai Tsujita, Partner, Addet & Wealth Management, PriceawaterhouseCoopers Aarata LLC

②【13:00】Panel: Try, Learn, Discover: Helping Retail Investors Understand the Pros and cons of ETF Strategies

Panelists:

Tomoyoshi Hirose,Vice Chairman, Founder, Money Desighn Co.,Ltd.

Shinichiro Kai, Chief Executive Office, Folio Co.,Ltd.

Masafumi Watanabe, Senior ETF Strategist, Vanguard Investments Japan.,Ltd.

Makoto Miki, Financial Literacy Suport Department, Tokyo Stock Exchange Inc.

Moderator:

Hisashi Kaneko,"Japan’s Asset Management Business," General Manager, Nomura Research Institute

①【13:55】 A Closer Look at the ETF Market Making Incentive Scheme Landscape and its Market Impact

Kei Okazaki, Head of ETF Secondary Trading, Manager of Strategic Planning Group, Equities, Tokyo Stock Exchange Inc.

②【13:55】Lessons from Abroad:How Can U.S.FA's Inform ETF Implementation in Japan?

Michael Jones, Chairman and Chief Executive Officer, Caravel Concepts, LLC

Stuart Magrath,Senior Director, Channel Management, Australia and New Zealand, S&P Dow Jones Indices

①【14:30】Panel: What Structural Changes are Needed for the Continued Expansion of the ETF Market?

Panelists:

Koei Imai, Head of ETF Center, Nikko Asset Management Co.,Ltd.

Takeki Yamada, Head of Japan Business, Institutional Trading, Flow Traders

Yosuke Kikuchi, Chief Manager of Strategic Planning Department, Japan Securities Clearing Corporation,Inc.

Noritaka Yoshimura, Passive Management Department, Equity Manegement Department, Senior Fund Manager, Daiwa Asset Management Co.,Ltd.

Moderator:

Osamu Okuyama, Head of Index Products, Investment and Reserch Division, Nomura Assetmanagement Co.,Ltd.

②【14:30】Panel: What is the Role of IFA and RIA in Japan?

Panelists:

Ryuji Ando, Chief Executive Officer, Reliable Investment Advisors Japann Co.,Ltd.

Masaki Kanai, Executive Officer, IFA Dept., SBI SECURITIES Co.,LTD.

Hiroki Nakagiri, Chief Executive Officer, GAIA Co.,Ltd.

Moderator:

Koichi Ito, Senior Executive Director of the Japan Association for Financial Planners (a Non-Profit Organization), Professer of Chiba University

【15:25】Trading Japan and globally listed ETFs efficiently-Live trading demo

Takeki Yamada, Head of Japan Business, Institutional Tradeing, Flow Traders

①【16:10】Panel: How IndexInnovation Is Reshaping Institutional Solutions

Panelists:

Yasunori Itaya, Manager, Office of Policy Planning, Members Center, Pension Fund Association

Yoshihisa Suzuki, Director of Fund Management, Financial Affairs Division, Waseda University

Keiichi Nakajima, General Manager for Investment Planning, Corporate Planning Dept., MS&AD Insurance Group Holdings,Inc.

Hiroyuki Kishimoto, Vice President, Institutional Sales Dept., Deutsche Asset Management (Japan) Limited (DWS)

Yoshinobu Hirano, Managing Director, Nara Chuo Shinkin Bank

Moderator:

Kana Kawasaki, Senior Director, S&P Dow Jones Indices

②【16:10】Panel: Practical Portfolio Construction Ideas for Challenging Times

Panelists:

Hideki Oe, Chief Executive Officer, Office Libertas Co.,Ltd.

Tesuro Ii, Precident and CEO, Commons Asset Management,Inc.

Moderator:

Kohei Morinaga, Chief Executive Officer, Manene Co.,Ltd.

【17:05】Panel: Keeping an Eye On the Future:Asset Management Strategies for the Next Generation

Panelists:

Hiroki Tadera, ETF Grouep, Investment Trust Marketing Div., Nomura Assetmanagement Co.,Ltd.

Hiroaki Doi, Equity & Derivatives Business Unit Products Division, Rakuten Securities,Inc.

Wataru Ishikawa, Vice President, ETF Business Planning, Nomura Securities Co.,Ltd.

Kei Okazaki, Head of ETF Secondary Trading, Manager of Strategic Planning Group, Equities, Tokyo Stock Exchange Inc.

Moderator:

Kohei Sasaki, Senior Maneger, Mitsubishi UFJ Kokusai Asset Management Co., Ltd

【17:55】Closing

Yoshiyuki Makino, Head ofJapan Office, S&P Dow Jones Indices

There were sponsor companies booths standing in exhibition hall and many attendees visited the booth during break time in between sessions.

This is the 11th year and the first time held for two days. Domestic and foreign ETF related professionals, such as institutional investors, asset management companies, securities companies, banks and financial planners were invited to the conference. Coming of new financial era, based on entry into financial business by many different industries, S&P DJI intend to continue deepen the discussion for Day 2 about present and future financial business, surrounding the investment products.

*Go to Day2 Report

( 写真提供:S&P ダウ・ジョーンズ・インデックス / 記事、編集・制作:プロモーション事業部 @株式会社グッドウェイ )